- #Business financial calculators how to#

- #Business financial calculators trial#

- #Business financial calculators plus#

- #Business financial calculators series#

provides the Flexbase Card® Corporate Card, which is issued by Celtic Bank, a Utah-chartered Industrial Bank (Member FDIC). Terms and conditions apply and are subject to change. ©2023 Flexbase Technologies, Inc., “Flexbase” and the Flexbase logo are registered trademarks Flexbase products may not be available to all customers. The Flexbase Card is not available yet in the following states: CA, ND, SD, VT, and NV. See your Flexbase Line of Credit Agreement for details. Interest applies when payments are late - there will be a default APR interest (up to 24%) applied when payments are late. Financial calculators are found in many university classrooms and are required for the CFA Program and industry professionals.0% interest for the Flexbase Card applies if all payments are made on time.

#Business financial calculators series#

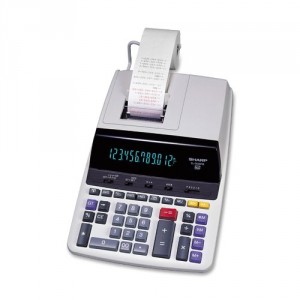

Financial Calculators Overviewįinancial calculators are a useful tool for determining the present value, future value, discount rate, or monthly payment of a series of cash flows.

#Business financial calculators how to#

Knowing how to efficiently use your financial calculator before going into the exam will improve your confidence and will speed up your calculations (time is of the essence for all 3 exams). It is important for Candidates to master the functionality of their calculators well before exam day.

#Business financial calculators plus#

The two models are the Texas Instruments BA II Plus (or BA II Plus Professional) and the Hewlett Packard 12C (including the HP 12C Platinum, 12C Platinum 25 th anniversary edition, 12C 30 th anniversary edition, and HP 12C Prestige). There are 2 financial calculators that CFA Candidates are authorized to use during the exams. Financial calculators have the power to quickly calculate the IRR of this investment by simply entering each cash flow in its respective year and hitting a “compute IRR” key. Without a financial calculator, it is difficult to solve this cubic equation or polynomial equations of a higher degree. Solving for r in this equation will provide us with the IRR of the investment. The investment will pay back (inflows) a stream of cash flows at the end of each year for the next three years of $2,000, $3,000, and $8,000, respectively.

A financial calculator accounts for inflows and outflows of varying sizes over multiple periods to determine the return (or cost) of an investment.įor example, assume you are presented with an investment which requires an initial $10,000 payment (outflow).

#Business financial calculators trial#

Short of the trial and error methodology, solving for a constant discount rate over 3 or more periods is extremely difficult. The IRR is a constant discount rate (“ r”) that equates all future cash inflows and outflows to an initial cash flow. IRR is a critical calculation across multiple disciplines from calculating the yield-to-maturity on a bond for a portfolio manager to the determining the required return of building a new factory for a project manager. The ability to calculate IRR is arguably the most powerful function of financial calculators. Calculating Internal Rate of Return with a Financial Calculator We are presented with the following equation to calculate the NPV:Ī financial calculator allows you to enter cash inflows and outflows and a discount rate at different time periods to easily solve this equation without having to deal with the messy fractions and exponents involved.īy quickly discounting the future cash flows, the Manager in this problem will see that the project has a negative NPV of -$11,195, and should determine not to proceed with the project. The Manager wishes to discount these future cash flows at a 10% discount rate, which is considered the project’s required return. Managers and executives will calculate the NPV of a new project (or a series of projects) to determine whether the future cash flows justify the initial investment.įor example, let’s look at a project that requires an initial investment of $100,000 and will provide cash inflows at the end of the next 3 years of $20,000, $40,000, and $50,000, respectively. Calculating Net Present Value with a Financial Calculator Financial calculators also provide the ability to quickly evaluate the future value of an investment or determine the monthly payment on an annuity. The primary difference between financial calculators and non-financial calculators is the ability to calculate the net present value (NPV) and the internal rate of return (IRR) on a series of cash flows. Financial calculators are an essential tool for CFA Candidates, university business students and industry professionals.

0 kommentar(er)

0 kommentar(er)